- Introduction

- Benefits of Sustainability and the Circular Economy

- Challenges and Potential Drawbacks

- Case Studies

- Evaluating the Financial Impact

- Balancing Profit and Purpose

- Conclusion

1. Introduction

In an era where business practices are increasingly scrutinized for their impact on the environment and society, sustainability and the circular economy have emerged as pivotal factors influencing corporate decision-making. The traditional notion that sustainability efforts might hinder profitability has given way to a new understanding: that businesses can no longer thrive by prioritizing financial gain alone. This paradigm shift prompts a crucial question: “Is Sustainability and the Circular Economy a Benefit or Deficit to the Bottom Line?”

This article embarks on a journey to explore the intricate interplay between sustainability, the circular economy, and financial performance. It is a voyage through the dual nature of these practices: on one hand, they offer a multitude of benefits to businesses, from cost reduction and enhanced brand reputation to regulatory compliance and access to new markets. On the other hand, they pose challenges, from upfront investments to navigating short-term versus long-term financial considerations.

Throughout this exploration, we will examine real-world case studies that illustrate how companies, across various industries, have reaped the rewards of sustainability initiatives while navigating the challenges. We will also dive into the critical aspects of evaluating the financial impact of these practices, quantifying the return on investment, and utilizing various tools and metrics for assessment.

As we delve into this multifaceted topic, it becomes evident that achieving a balance between profit and purpose is not just a commendable aspiration but a financial imperative for businesses in a rapidly evolving world. By aligning financial goals with sustainability objectives, companies can not only secure and grow their bottom line but also contribute to a brighter, more sustainable future for all.

2. Benefits of Sustainability and the Circular Economy

Sustainability and the circular economy, once considered impediments to profitability, are now recognized as potent tools for enhancing the bottom line. In this section, we will delve into the numerous benefits that businesses can derive from adopting sustainable and circular practices.

2.1 Cost Reduction through Resource Efficiency

One of the most apparent benefits of sustainability and the circular economy is the potential for cost reduction through resource efficiency. In a world where resources are finite and their availability often subject to volatility, adopting practices that minimize resource consumption is not just environmentally responsible; it’s fiscally prudent.

Resource efficiency means making the most of what a company has, be it raw materials, energy, or water. It involves reevaluating production processes to reduce waste and implementing recycling and reusing strategies. These initiatives can significantly lower a company’s costs. For instance, when materials are recycled and reused in manufacturing processes, businesses save money on purchasing new materials, transporting them, and disposing of waste. Moreover, they often benefit from reduced energy and water bills by adopting sustainable practices.

In the face of rising energy costs and stricter environmental regulations, businesses that prioritize sustainability and resource efficiency are often better equipped to weather economic uncertainties.

Beyond cost savings, these practices can boost overall operational efficiency and competitiveness in the market.

2.2 Enhanced Brand Reputation and Customer Loyalty

In a world increasingly conscious of environmental and social issues, businesses that take sustainable and circular approaches not only reduce costs but also enhance their brand reputation. Customers are no longer passive consumers; they are conscious consumers who consider a company’s impact on the environment and society when making purchasing decisions.

By showcasing a commitment to sustainability, businesses not only attract environmentally conscious customers but also foster greater loyalty among existing clients. Sustainable practices send a powerful message: that the company is forward-thinking, responsible, and concerned about the well-being of the planet and its inhabitants.

This enhanced brand reputation can be a powerful asset in today’s competitive marketplace. Companies that are known for their sustainable and ethical practices often outperform their peers and are better positioned to weather crises. Customers are more likely to forgive and continue supporting companies with strong sustainability records in the face of adversity.

2.3 Regulatory Compliance and Risk Mitigation

Regulatory requirements are evolving, with governments worldwide imposing stricter rules and guidelines aimed at curbing environmental degradation and promoting sustainable practices. Businesses that are proactive in adopting sustainability and circular economy strategies often find themselves in a better position to comply with these regulations.

While some might view these regulations as additional costs, they can also be seen as opportunities. Companies that align with regulatory requirements are not only avoiding potential fines and legal disputes but are also positioning themselves as responsible corporate citizens. This can lead to favourable treatment from regulators and open doors to incentives and tax breaks designed to encourage sustainability.

Additionally, sustainability efforts can mitigate risks related to supply chain disruptions, which have become more prevalent in an interconnected global economy. By diversifying supply sources and adopting circular economy practices that reduce dependency on finite resources, companies can safeguard their operations against unforeseen disruptions and price fluctuations.

2.4 Access to New Markets and Customer Segments

Sustainability practices and circular economy models often open doors to new markets and customer segments. Consumers, businesses, Investors and governments are increasingly seeking out sustainable solutions. By aligning with this demand, companies can expand their reach.

For example, sustainable product certifications can facilitate entry into markets that prioritize eco-friendly options. Companies that develop circular economy models can cater to customers looking for durable, repairable, or upgradable products. Moreover, businesses that embrace sustainability can often tap into growing markets related to renewable energy, clean technology, and eco-friendly services.

In a global marketplace where consumers are becoming more discerning about their choices, businesses that fail to adapt to sustainability trends risk losing out on substantial revenue streams.

2.5 Attraction and Retention of Top Talent

In a competitive job market, attracting and retaining top talent is essential for business success. Sustainable practices and a commitment to the circular economy can significantly enhance a company’s appeal to job seekers, particularly among the younger workforce, often characterized by its environmental and ethical consciousness.

Sustainable businesses often find it easier to recruit and retain high-caliber employees. They are seen as progressive and are more likely to attract individuals who want to work for a company that aligns with their values. Furthermore, a company’s commitment to sustainability can lead to higher job satisfaction and productivity among employees who take pride in their workplace’s ethical and environmentally responsible practices.

In conclusion, the benefits of sustainability and the circular economy to a business’s bottom line are undeniable. From cost reduction through resource efficiency to the attraction and retention of top talent, the advantages extend across multiple dimensions. In the next section, we will explore the challenges and potential drawbacks businesses may encounter as they embark on their sustainability journey.

3. Challenges and Potential Drawbacks

While the benefits of sustainability and the circular economy are significant, it’s crucial to recognize that businesses can face challenges and potential drawbacks as they embrace these practices. Understanding these challenges is essential for making informed decisions and addressing them effectively.

3.1 Upfront Costs and Investments

One of the primary challenges in adopting sustainability and circular economy practices is the upfront costs and investments required. Implementing new technologies, overhauling processes, and training employees can be expensive. This initial financial outlay can be a deterrent for businesses, particularly smaller ones with limited budgets.

However, it’s important to consider these costs in the context of long-term savings and benefits. While the upfront investment may seem substantial, it often pays off over time through reduced operational costs, improved brand reputation, and access to new markets.

Centralized and government-supported funding does exist in many countries and regions and whilst the process to secure funding can be arduous the rewards can be significant. Perstorp recently secured EU funding of €97million towards a total investment of over €230million in its new green energy plant in western Sweden.

3.2 Short-term vs. Long-term Financial Considerations

Another challenge arises from the tension between short-term and long-term financial considerations. Some sustainability initiatives may take time to yield returns on investment, and businesses focused solely on short-term profits may find it difficult to commit to these longer-term strategies.

Balancing short-term financial goals with long-term sustainability objectives requires careful planning and a commitment to the broader vision of a company. Short-term sacrifices can lead to substantial long-term gains, but this requires a shift in perspective and a willingness to invest in the future.

3.3 Transition Challenges and Supply Chain Complexities

Transitioning to sustainable and circular practices often involves significant changes to a company’s operations. This transition can be complex, requiring adjustments to supply chains, production processes, and product design. These changes can be disruptive and pose logistical challenges.

Supply chain complexities, in particular, can be a significant hurdle. Businesses must ensure that their suppliers also adhere to sustainability and circular economy principles, which may involve negotiating new contracts or finding alternative suppliers. Additionally, establishing efficient reverse logistics for recycling and reusing materials can be challenging.

3.4 Measuring and Reporting Sustainability Impact

Accurately measuring and reporting the impact of sustainability initiatives can be challenging. While businesses often invest in sustainability to improve their environmental and social performance, it can be difficult to quantify these benefits in financial terms. This can make it challenging to communicate the value of sustainability to stakeholders, including investors and customers.

Fortunately, there are frameworks and metrics available to help businesses measure their sustainability impact. These include tools for assessing carbon emissions reductions, resource savings, and social impact. Companies can also engage in sustainability reporting to transparently communicate their progress to stakeholders.

3.5 Regulatory Uncertainty

While we discussed regulatory compliance as a benefit, it can also present a challenge due to regulatory uncertainty. Laws and regulations related to sustainability and the circular economy can change, potentially impacting a company’s compliance efforts and investment strategies. Businesses must stay informed and be agile in response to evolving regulatory landscapes.

Adapting to regulatory changes can be costly and time-consuming, but it’s an essential aspect of long-term sustainability planning. Companies that anticipate and prepare for regulatory changes are better positioned to thrive in a shifting legal environment.

In conclusion, it’s clear that embracing sustainability and the circular economy brings numerous benefits to businesses. However, there are also challenges and potential drawbacks that companies must navigate. By recognizing and addressing these challenges, businesses can better position themselves to reap the long-term financial rewards of sustainability. In the next section, we will delve into real-world case studies to illustrate how companies have successfully integrated sustainability into their operations.

4. Case Studies

To provide a practical perspective on the benefits and challenges of sustainability and the circular economy, we turn to real-world case studies. These examples demonstrate how companies from various industries have successfully integrated sustainability initiatives into their operations, achieving both financial and environmental gains.

4.1 The Coca-Cola Company: A Sustainable Supply Chain

The Coca-Cola Company is a global beverage giant that recognized the environmental impact of its supply chain. In response, the company launched its “World Without Waste” initiative, committing to collect and recycle the equivalent of every bottle or can it sells by 2030. This initiative not only addresses the growing problem of plastic waste but also creates a more resilient supply chain.

The financial benefits for Coca-Cola are evident. By investing in recycling infrastructure and reducing waste, the company can lower costs associated with raw materials and waste disposal. Additionally, the initiative enhances the company’s brand reputation, fostering customer loyalty and attracting environmentally conscious consumers. The long-term financial gains of these sustainability efforts are substantial.

4.2 Unilever: Sustainable Sourcing and Brand Growth

Unilever, a consumer goods giant, has embedded sustainability into its business model with its Sustainable Living Plan. The company has committed to sourcing 100% of its agricultural raw materials sustainably. This initiative not only minimizes the environmental impact of its supply chain but also secures the supply of essential ingredients.

The financial benefits for Unilever are multifaceted. Sustainable sourcing ensures a stable supply of ingredients, reducing the risks associated with price fluctuations and supply chain disruptions. Furthermore, Unilever’s sustainability efforts have driven brand growth, with sustainable brands like Dove, Ben & Jerry’s, and Seventh Generation outperforming others in the portfolio. The financial success of these sustainable brands demonstrates the tangible returns on Unilever’s sustainability investments.

4.3 Patagonia: Building a Loyal Customer Base

Outdoor apparel company Patagonia is renowned for its commitment to sustainability. The company has undertaken initiatives like the “Worn Wear” program, encouraging customers to buy and sell used Patagonia gear. This circular economy approach not only promotes reuse but also enhances customer loyalty and brand reputation.

The financial benefits for Patagonia are evident in its loyal customer base. Patagonia’s customers often become advocates for the brand’s environmental and ethical stance, resulting in a strong and engaged customer community. This community supports Patagonia, driving sales and reinforcing the company’s financial health.

4.4 Interface: Turning Sustainability into Profit

Interface, a global commercial flooring company, embarked on a journey to sustainability by launching its “Mission Zero” initiative. The company committed to becoming a carbon-neutral, zero-waste enterprise. The financial benefits of this initiative have been substantial, including significant cost savings from reduced energy consumption and waste.

By adopting sustainable practices, Interface not only reduced operational costs but also attracted customers seeking environmentally friendly solutions. The company has transformed sustainability into a selling point, enhancing its brand and driving business growth.

These case studies illustrate that sustainability and the circular economy can deliver tangible financial benefits to businesses. From cost reduction and enhanced brand reputation to securing supply chains and attracting environmentally conscious consumers, the advantages are evident. In the next section, we will delve into the critical aspect of evaluating the financial impact of sustainability initiatives on a company’s bottom line.

5. Evaluating the Financial Impact

As businesses invest in sustainability and circular economy initiatives, it’s essential to assess the financial impact of these efforts. This section explores the methodologies, tools, and metrics available for evaluating the effect of sustainability on the bottom line.

5.1 Analyzing the Financial Statements of Sustainable Businesses

One way to assess the financial impact of sustainability initiatives is to analyze the financial statements of sustainable businesses. These statements can reveal insights into cost savings, revenue growth, and overall profitability resulting from sustainable practices. Comparing the financial performance of sustainable and non-sustainable peers within the same industry can provide valuable benchmarks.

Key financial indicators to consider include:

- Cost Reduction: Analyzing reductions in operating costs related to resource efficiency, waste reduction, and energy savings.

- Revenue Growth: Evaluating whether sustainability efforts have led to increased sales or market share due to enhanced brand reputation.

- Profit Margins: Assessing whether sustainability initiatives have positively influenced profit margins.

- Return on Investment (ROI): Calculating the return on investment for sustainability projects to determine whether they are financially sound.

5.2 Quantifying the ROI of Sustainability Initiatives

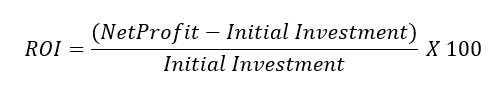

Quantifying the return on investment (ROI) of sustainability initiatives is essential for evaluating their financial impact. ROI provides a clear measurement of the financial returns relative to the initial investment in sustainability projects. The basic formula for ROI is:

To calculate ROI, businesses must consider both the costs associated with implementing sustainability initiatives and the resulting financial benefits. This helps in understanding whether the investments are generating a positive return over time.

5.3 Tools and Metrics for Assessing Sustainability’s Effect on the Bottom Line

Several tools and metrics can aid in assessing the impact of sustainability on a company’s financial performance:

Sustainability Reporting: Many organizations use sustainability reports to communicate their environmental and social performance. These reports provide stakeholders with detailed information about a company’s sustainability initiatives, making it easier to evaluate their impact.

Carbon Accounting: Carbon accounting involves quantifying a company’s greenhouse gas emissions. This metric is critical for understanding a company’s environmental footprint and the potential cost savings from emissions reduction initiatives.

Environmental, Social, and Governance (ESG) Metrics: ESG metrics evaluate a company’s performance on environmental, social, and governance factors. They help investors and stakeholders assess a business’s sustainability efforts and their impact on financial performance.

Life Cycle Assessment (LCA): LCA assesses the environmental impact of a product or process across its entire life cycle. This approach can identify areas for resource and energy efficiency improvements.

Supply Chain Assessment: Evaluating the sustainability of a company’s supply chain can uncover opportunities for cost reduction, risk mitigation, and enhanced brand reputation.

Social Impact Measurement: For companies with strong social sustainability objectives, measuring the social impact of their initiatives can be valuable for assessing their financial performance. Metrics may include employee retention rates, community engagement, and customer satisfaction.

By using these tools and metrics, businesses can gain a comprehensive understanding of how sustainability initiatives influence their financial performance.

In the final section of this article, we will explore the critical concept of balancing profit and purpose, emphasizing that companies must align financial goals with sustainability objectives to thrive in a changing business landscape.

6. Balancing Profit and Purpose

In the contemporary business landscape, the imperative to balance profit and purpose has never been more critical. The concept of the “triple bottom line” (People, Planet, Profit) underscores the necessity of considering not only financial outcomes but also social and environmental impacts. Businesses must proactively align their financial goals with sustainability objectives to thrive in a changing world.

6.1 The Triple Bottom Line: People, Planet, Profit

The traditional bottom line focuses solely on financial performance, measuring a company’s profitability. However, the triple bottom line expands this perspective by introducing two additional dimensions: people and the planet.

People: This dimension addresses the social impact of a company’s operations. It encompasses factors like employee well-being, workplace diversity, community engagement, and ethical labour practices. Companies that prioritize this aspect often find it easier to attract and retain top talent, fostering a motivated and productive workforce.

Planet: The planet dimension focuses on a company’s environmental impact, including resource consumption, emissions, and waste. Embracing sustainable and circular practices helps reduce the ecological footprint of a business. This, in turn, can lead to cost savings and enhanced brand reputation.

6.2 Strategies for Aligning Financial Goals with Sustainability Objectives

To effectively balance profit and purpose, companies can employ various strategies:

Integrate Sustainability into Business Strategy: Sustainability should not be an afterthought; it must be integrated into a company’s core strategy. By embedding sustainability into the decision-making process, businesses can ensure that sustainability objectives align with financial goals.

Set Clear Sustainability Goals: Establishing measurable sustainability goals is essential. These goals should be specific, time-bound, and aligned with financial targets. Regularly monitoring progress and adjusting strategies accordingly is crucial.

Incentivize Sustainability: Rewarding employees and departments for achieving sustainability objectives can create a culture of responsibility and encourage the pursuit of sustainability and financial success simultaneously.

Engage with Stakeholders: Actively engage with stakeholders, including customers, investors, and the community, to better understand their expectations and concerns. Companies can then adapt their strategies to meet these expectations, driving financial growth.

Innovation and Research: Invest in research and development to drive innovation in sustainable products, services, and processes. Such innovations can open up new markets and revenue streams while reducing environmental impacts.

6.3 Navigating Ethical Dilemmas

Balancing profit and purpose may also involve navigating ethical dilemmas. Companies often encounter situations where short-term financial gains conflict with long-term sustainability objectives. In these instances, businesses must make ethically sound decisions that prioritize the well-being of people and the planet.

For example, a business may face a situation where a less sustainable, cheaper supplier offers short-term cost savings. Choosing this option may boost profits in the near term but could compromise long-term sustainability goals. Navigating such ethical dilemmas requires careful consideration of the broader consequences and a commitment to the triple bottom line.

7. Conclusion

In our exploration of the relationship between sustainability, the circular economy, and a company’s bottom line, we’ve witnessed a profound transformation in the business landscape. Sustainability and the circular economy, once perceived as potential financial burdens, have emerged as powerful tools that businesses can harness to not only thrive but also contribute positively to the planet and society.

The benefits of sustainability are diverse, encompassing cost reduction, enhanced brand reputation, regulatory compliance, access to new markets, and the attraction and retention of top talent. Real-world case studies have demonstrated that businesses can achieve both financial success and sustainability objectives, further solidifying the notion that profit and purpose can coexist.

Measuring the financial impact of sustainability initiatives involves analyzing financial statements, quantifying ROI, and employing various tools and metrics. This assessment not only reveals the potential for cost savings and revenue growth but also provides transparency in communicating a company’s sustainability performance.

The imperative for businesses is clear: align financial goals with sustainability objectives, adopt the triple bottom line approach, and navigate ethical dilemmas to ensure a brighter, more sustainable future. As the world evolves, this balanced approach is not just a choice; it is a necessity, offering hope for a more sustainable and prosperous world for generations to come.